Why I’m skeptical that HSAs will work to reduce spending greatly – Part 1 | The Incidental Economist

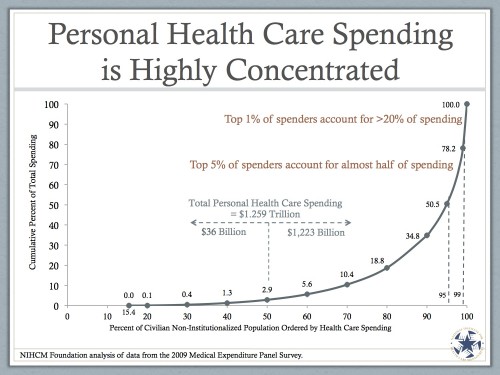

You’ve seen a slide like this before, I bet. But basically, what it’s showing is that a small number of people account for a ton of personal health care spending. In fact, the bottom 50% of spenders account for only $36 billion in personal health spending. That’s less than 3% of all of it.

Why is this important? Well, because the entire idea of health savings accounts and increased cost sharing is to encourage people to spend less on personal health spending. The idea is that people who don’t really need the care will choose to spend less. What we often ignore, however, are the high spenders. Those people, on the right side, would blow through their health savings account pretty quickly. At that point, they have no more deductibles and no more co-pays, and there are no more incentives to spend less. So the whole idea won’t work on then. It might, however, work on people who don’t spend as much.

But as the chart shows, there’s not that much to save there.Why I’m skeptical that HSAs will work to reduce spending greatly – Part 2 | The Incidental Economist

Health savings accounts, and increased cost sharing, will likely work for those who don’t need the care and are healthy. But they spend so little, that even if they are influenced, we won’t save much. Those who are spending the real money are older, sicker, and need help. If they spend less, it’s more likely they will suffer. And it’s likely many won’t spend less, since there’s no chance of their keeping money in their accounts. If they don’t spend less, then we can’t save real money.

I get why people think cost sharing and HSAs will work. But when the theoretical possibilities meet the real demographics and patterns of spending, I can’t see how this will work.

Sphere: Related Content

No comments:

Post a Comment